What this means is that only the top stocks in terms of market cap remain in the index. The Nifty 50 is a market cap-based index, like many of the top global indices. These stocks are also the most liquid securities and together account for over two-thirds of the free-float market cap of traded securities in Indian exchanges. This index tracks the performance of the 50 large bluechip companies traded in the NSE based on free-float market capitalisation. Rise in daily COVID cases, speculation of complete lockdown in the Maharashtra state.The NIFTY 50 is a diversified 50 stock index that represent key sectors of the economy. ĭriven by the weak economic outlook as predicted by the United States Federal Reserve. ĭriven by the COVID-19 pandemic after WHO declared it a pandemic. ĭriven by the Union Budget FY 2020 and coronavirus pandemic which saw global breakdown a day before the budget. Panic Fall, due to Oil price Increase and rupee fall against US Dollar.ĭue to Multiple PSU Bank Merger Announcements. ĭriven by the 2018 Union budget of India and Global breakdown. ĭriven by the Demonetization move by the Indian Government and the 2016 US Election Results. ĭriven by the meltdown in the Chinese Stock market. Crashes also occurred in Thailand, Indonesia, South Korea and Philippines.ĭue to depreciation of the Indian rupee. Investors deserted emerging Asian shares during the Asian Financial Crisis.

JSTOR ( October 2020) ( Learn how and when to remove this template message)įollowing are some of the notable single-day falls of the NIFTY 50 Index.Unsourced material may be challenged and removed. Please help improve this article by adding citations to reliable sources. This article needs additional citations for verification.

#NIFTY 50 STOCKS FREE#

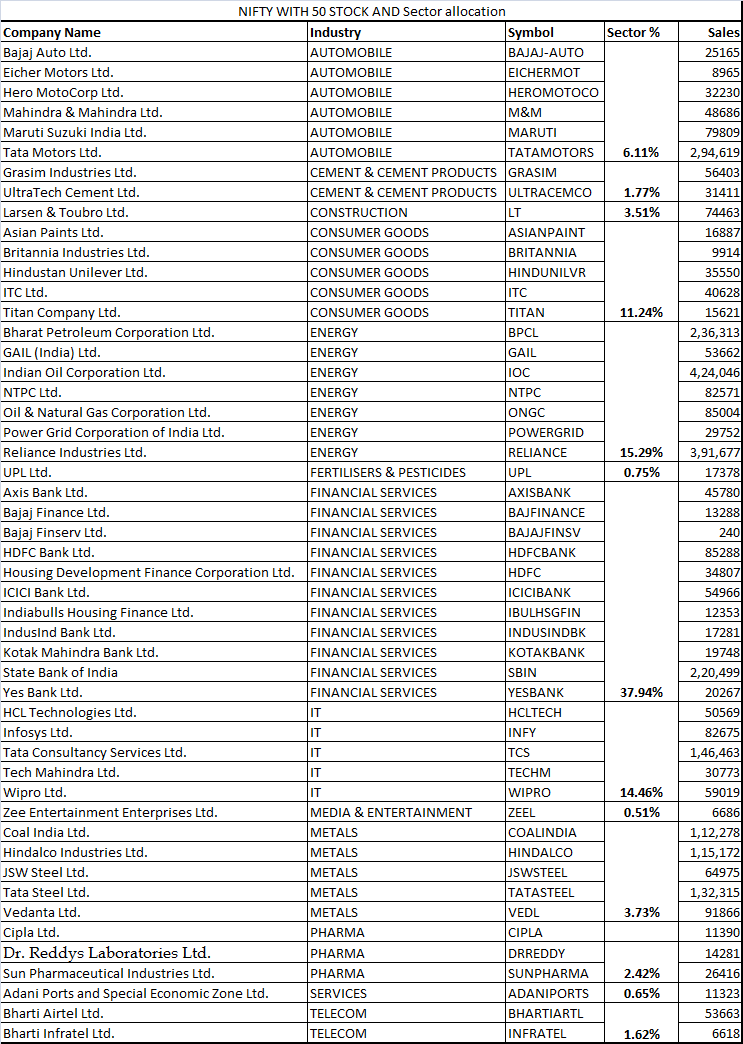

Constituents Company NameĬhanges in index constituents since Nifty 50 adopted free float criteria in 2009: The base value of the index has been set at 1000 and a base capital of ₹ 2.06 trillion. The base period for the NIFTY 50 index is 3 November 1995, which marked the completion of one year of operations of the equity market segment on NSE. On 26 June 2009, the computation was changed to a free-float methodology.

#NIFTY 50 STOCKS FULL#

The index was initially calculated on a full market capitalisation methodology.

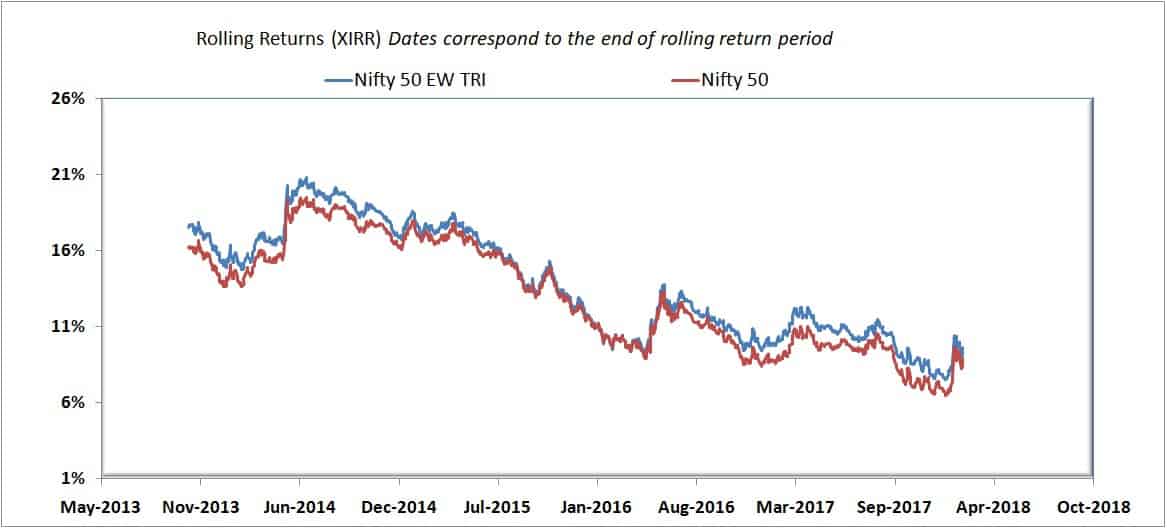

The NIFTY 50 index is a free float market capitalisation weighted index. As of January 2023, NIFTY 50 gives a weightage of 36.81% to financial services including banking, 14.70% to IT, 12.17% to oil and gas, 9.02% to consumer goods, and 5.84% to automobiles. The NIFTY 50 index covers 13 sectors of the Indian economy and offers investment managers exposure to the Indian market in one portfolio. Between 2008 & 2012, the NIFTY 50 index's share of NSE market fell from 65% to 29% due to the rise of sectoral indices like NIFTY Bank, NIFTY IT, NIFTY Pharma, and NIFTY Next 50. WFE, IOM and FIA surveys endorse NSE's leadership position. NIFTY 50 is the world's most actively traded contract. The NIFTY 50 index has shaped up to be the largest single financial product in India, with an ecosystem consisting of exchange-traded funds (onshore and offshore), and futures and options at NSE and SGX. The Nifty 50 index was launched on 22 April 1996, and is one of the many stock indices of Nifty. NSE Indices had a marketing and licensing agreement with Standard & Poor's for co-branding equity indices until 2013. Nifty 50 is owned and managed by NSE Indices (previously known as India Index Services & Products Limited), which is a wholly owned subsidiary of the NSE Strategic Investment Corporation Limited. It is one of the two main stock indices used in India, the other being the BSE SENSEX. The NIFTY 50 is a benchmark Indian stock market index that represents the weighted average of 50 of the largest Indian companies listed on the National Stock Exchange. Performance of the NIFTY 50 index between 19

0 kommentar(er)

0 kommentar(er)